Thanksgiving Day Prices: "Fowl" Play in the Ag and Food Industries

Many consumers have cried “fowl” over the rising Thanksgiving prices.

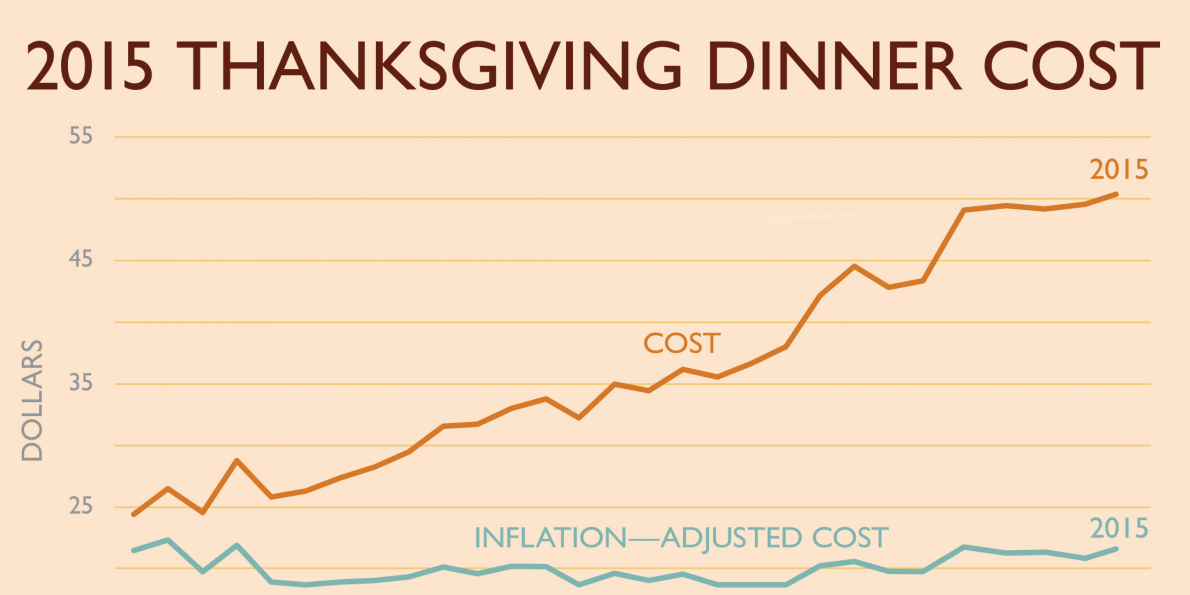

The American Farm Bureau Federation recently reported that a  Thanksgiving meal for 10 will cost a family $50.11 on average this year. This will be the first time in history that the holiday meal will surpass the $50 mark. This increase in price has been mainly contributed to the decrease in production of turkeys as well as many other main ingredients. While this may be true, when you factor in inflation, the price of Thanksgiving dinner has actually decreased in the last twenty years. In fact, Thanksgiving dinner is following a similar pattern to all other food products nationwide. Grocers, growers, and food suppliers are looking for leftovers from the once booming industry as food prices continue their 50 year decline. Low prices are not always an encouraging sign for the economy and can signal wage stagnation, deflation, and reduce the incentive for investments in infrastructure and service.

Thanksgiving meal for 10 will cost a family $50.11 on average this year. This will be the first time in history that the holiday meal will surpass the $50 mark. This increase in price has been mainly contributed to the decrease in production of turkeys as well as many other main ingredients. While this may be true, when you factor in inflation, the price of Thanksgiving dinner has actually decreased in the last twenty years. In fact, Thanksgiving dinner is following a similar pattern to all other food products nationwide. Grocers, growers, and food suppliers are looking for leftovers from the once booming industry as food prices continue their 50 year decline. Low prices are not always an encouraging sign for the economy and can signal wage stagnation, deflation, and reduce the incentive for investments in infrastructure and service.

The agriculture and food industry makes up over 9% of the workforce in the US, which amounts to over 17.3 million jobs. While the productivity in this sector has grown substantially, wage growth has not followed suit. Hourly and salaried employees have only seen a 0.2% per year increase in their pay. This really amounts to zero, as it matched the inflation rate perfectly. This trend can be attributed to the gradual decline of revenues as a result of the loss of value on many food products.

Economists have used the Food Price index (FFPI) to predict inflationary trends since the beginning of modern economic theory. The decline in the FFPI corresponds with the current low inflation rate trend. Low inflation also has a negative effect on wages. Since there is little to no inflationary pressure, as well as a low unemployment rate, workers have little leverage to negotiate wage increases. If this trend continues and ultimately deflation occurs, consumer spending will decrease as consumers will delay purchases with the promise of cheaper options in the future.

Low food prices decrease the incentive for companies to make investments in infrastructure and added services. Not only do companies have less income to make investments, they also have a hard time justifying borrowing money. Low inflation and falling prices/revenues makes the loan payment a higher portion of their income, reducing the attractiveness of the low interest rates.

As a consumer, it is pretty easy to be thankful for lower food prices, but it is important to look at the big picture. With that in mind, when you sit down to eat your Thanksgiving dinner, please give thanks to all the people who have worked hard to supply you with your affordable yet delicious meal.